How does your company's climate impact stack up?

Free tool: Answer three simple questions, and we'll estimate your company's emissions, leveraging a leading economic climate model with 4m+ data points. Plus, compare against industry benchmarks.

The Bend Scorecard is 100% free, and always will be.

Discover your “number to beat”

Explore and compare benchmarks across 1,000+ industry segments, and further broken out by country and revenue bands. No proprietary data required.

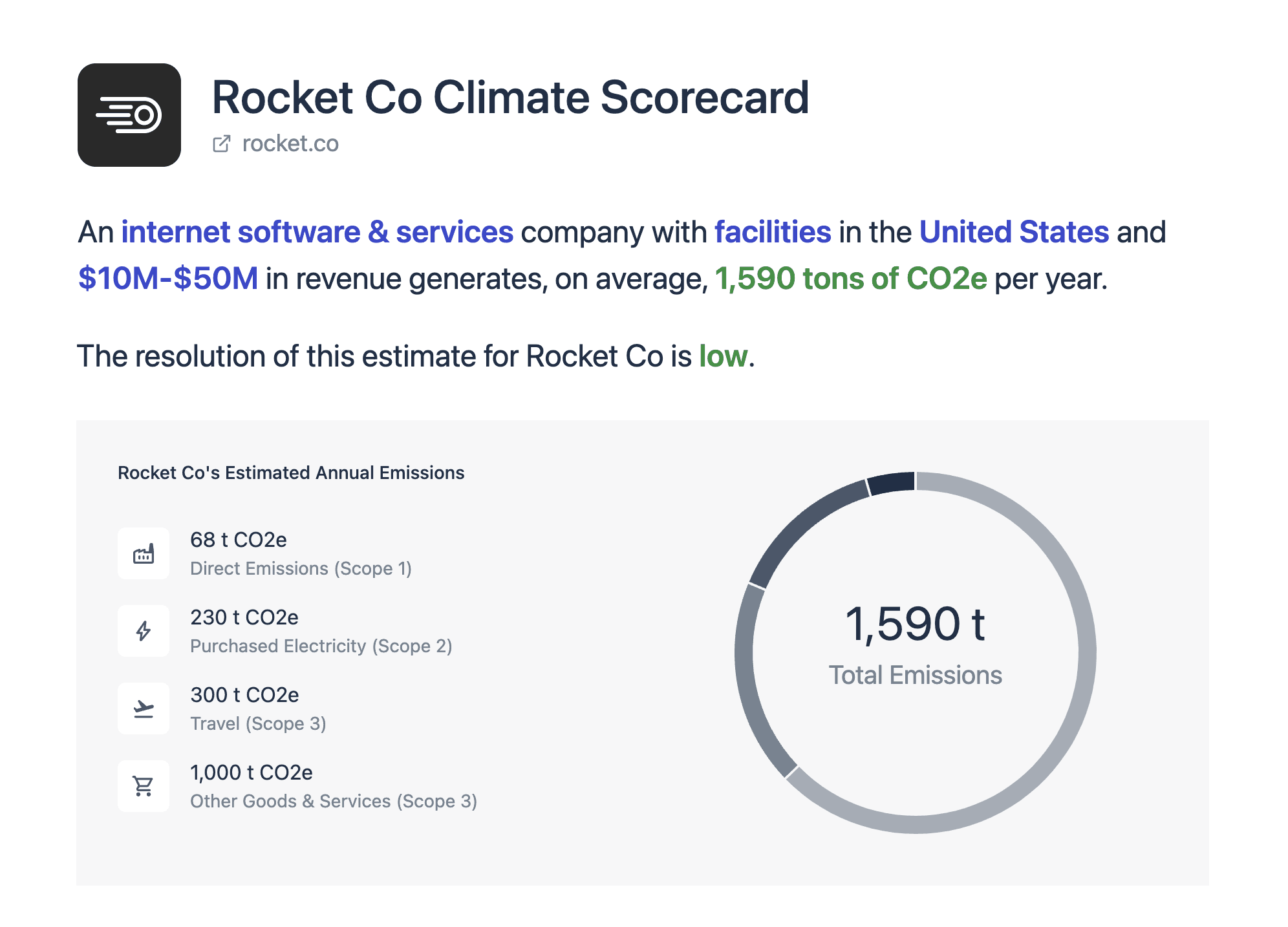

When it comes to estimating emissions, it's important to benchmark against peer companies. For example: if you work at a software company in the US with $5m-$10m in revenue, you'll want to compare against other software companies in the US with $5m-$10m in revenue.

Bend Scorecard has you covered — we look up public data about your company or organization based on your company URL — your industry (NAICS code), your location, and a rough (and adjustable) revenue estimate — and we use this data to provide relevant benchmarks.

This initial benchmark step takes no more than a couple minutes.

For organizations that want to go the next step and see how you specifically stack up, you can securely import your financial data (either from your card / bank, or from your accounting software), and Bend will estimate your specific emissions, broken out by month, category, and merchant.

Aside from benefits to the planet, climate action is also good for business:

- Supplier requirements: More and more large companies — from Salesforce, to Amazon, to Walmart, to REI — are requiring their suppliers measure their emissions and set reduction targets. If you want to sell your products and services to this growing list of companies, you'll need to start assessing your climate impact. Climate disclosure is fast becoming an expectation, similar to SOC 2 and other forms of supplier compliance.

- Investor pressure: Upstream from your company, asset managers face their own set of pressure points, both from LPs concerned about the impact of their investments, and from an expanding set of disclosure regulations. From private equity to venture — e.g. the recently announcemd Venture Climate Alliance announced by USV, Tiger, and a growing list of VCs — many startups will soon be required to address their climate impact, even in the earlier stages of growth.

- Regulations: Disclosure requirements are rapidly evolving across the world. In the EU, companies that have two or more of (1) 250+ employees, (2) €40M+ annual revenues, (3) €20M+ balance sheet, are required to disclose. Companies with operations in the UK have more stringent requirements. And in the US, the SEC has put together a similar proposal (the final rule is expected to be released in late 2023). Finally, companies with operations in California are now subject to disclosure laws (SB 253 and 261), and federal contractors are subject disclosure requirements, as part of the Biden Administration's sustainability push. The trendline is clear: more and more, companies are being compelled to track their emissions.

- Customer demand: Enhance your brand's reputation and set your brand apart with a commitment to sustainability. 57% of customers would change providers to reduce environmental impact, and 71% would pay a price premium for sustainable brands (IBM).

Bend Scorecard has two modes: one that tells you about the industry you're in, and one that tells you about your specific operations:

As a first pass, we'll determine your industry, location, and the scale of your business, and present benchmark data. This data is useful as a reference point. But it doesn't provide any information about how you stack up, relative to your peers.

These estimates are based off Exiobase, a global, detailed Multi-Regional Environmentally Extended Supply-Use Table (MR-SUT) and Input-Output Table (MR-IOT). They were developed with extensive input from our methodology lead (a PhD with degrees in Earth Sciences and Economics).

In order to understand how your specific business stacks up, we give you the opportunity to pull in 3rd party financial data. We have an overview of the relevant methodology, and corresponding accuracy, in our How It Works guide.

In order to explore your industry benchmarks, we do not need any proprietary data. All you'll need is your general industry classification. We streamline this step by looking up information based on your company URL (leveraging a tool called Clearbit).

In order to review your specific sustainability performance, we'll need your financial data. We keep this data private. We're SOC 2 certified by Vanta — please review our Security page for more.

We don't make any money off the Bend Scorecard. We offer other products, including climate-friendly corporate cards and a climate data API, that do generate revenue. The Scorecard is intended as a showcase of our technology.

Let's make it easy to be green

Get a Bend Scorecard for free, in minutes.